As the middle class struggles to make gains and President Barack Obama strives to shine a spotlight on the issue of income inequality, an unlikely constituency is looking for ways to close the nation’s growing wealth gap: A handful of top U.S. business tycoons.

These advocates point to notions of fairness and admit to twinges of guilt, but the core concern driving all of them — left, right and libertarian — is a belief that the economy doesn’t function efficiently when the wealth gap is wide. They are proposing solutions that range from pressuring fellow entrepreneurs to pay workers more to simply giving their money back to the government to redistribute.

Since roughly 1980, the wealthy have been prospering while the middle class stagnates or falls behind. Members of the 0.1 percent now make at least $1.7 million a year and grab 10 percent of the national income, while the median annual household income has dropped, landing at $51,017.

The gap is growing wider. Income for the highest-earning 1 percent of Americans soared 31 percent from 2009 through 2012, after adjusting for inflation. For everyone else, it inched up an average of 0.4 percent.

As U.S. society has grown more unequal, rich men and women have set up clubs and foundations to encourage economic parity, and they are actively lobbying for change.

The figure of the fairness-conscious billionaire has a precedent, said Harvard Business School professor Michael Norton. During the Gilded Age, at the end of the 1800s, tycoons took steps to increase equality and help the working class.

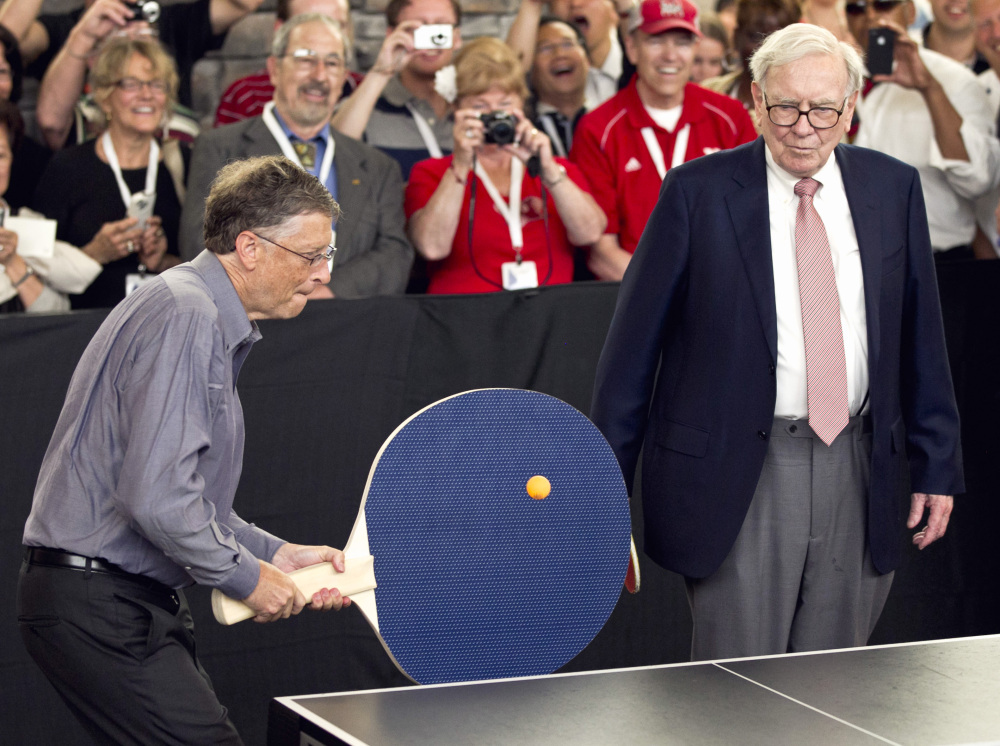

“Names like Carnegie, Mellon and Rockefeller — the (Warren) Buffet and (Bill) Gates of their days — grace universities, museums and medical centers in part because the originators of those fortunes gave back,” Norton said. “In the same way that some businesspeople are now taking steps to address climate change due to its effects on costs and revenues … the notion that inequality can be bad not just for ethical reasons, but for financial reasons, is one that is increasingly embraced by businesspeople.”

Here’s a look at some of these opponents of the widening gap between the poor and, well, themselves.

Buffett: the billionaire pied piper

The most visible of the superrich Robin Hoods is investor Warren Buffett, who has persuaded dozens of billionaires to give away large portions of their fortunes. Buffett, 83, is the second-richest American, according to Forbes magazine, with a net worth of $58.5 billion. He heads Berkshire Hathaway Inc., which owns everything from the insurance company GEICO and Dairy Queen to underwear maker Fruit of the Loom.

For years, he has advocated policies to close the wealth gap, saying reforms are necessary for the nation’s continued prosperity. Buffett has famously complained that he pays a lower tax rate than some of his most menial-wage employees. That’s because, like many moguls, much of his income comes from capital gains and dividend payments, which are taxed at a lower rate than ordinary wages. His activism gave rise to Obama’s proposed “Buffet rule,” which would ensure that anyone making more than $1 million per year pay at least the same rate as middle-income taxpayers.

The self-made Omaha, Neb., magnate has also for years targeted unequal wealth accumulation. Buffet advocated for a progressive estate tax before members of Congress, saying in 2007, “Dynastic wealth, the enemy of a meritocracy, is on the rise. Equality of opportunity has been on the decline. A progressive and meaningful estate tax is needed to curb the movement of a democracy toward plutocracy.”

Buffett, who did not immediately respond to questions submitted via his assistant, has played a key role in encouraging his peers to redistribute their wealth by choice. In 2010, he launched the Giving Pledge program in which wealthy entrepreneurs publicly promise to donate at least half of their riches to charity. Adherents including Facebook CEO Mark Zuckerberg, oil tycoon T. Boone Pickens and former New York Mayor Michael Bloomberg.

Unz: the republican who favors a raise

Not all members of the super-rich taking up the issue of inequality are progressives. Ron Unz, a Silicon Valley millionaire and registered Republican who once ran for California governor, is advocating the highest minimum wage in the country for his home state. Unz rose to fame when he spearheaded a 1998 ballot proposal that dismantled California’s bilingual education system. He later became publisher of The American Conservative, a libertarian-leaning magazine.

Lately, he has become obsessed with the idea that a wage hike is the best way to advance the conservative ideal of reducing dependence on government programs. Frustrated with the gridlock in Congress, Unz is pouring his own money into a November ballot measure that would increase the minimum wage in California to $12 an hour in 2016.

At that level, he said in an interview with The Associated Press, “every full-time worker would be earning almost exactly $25,000 and every full-time worker couple $50,000. Under normal family circumstances, those income levels are sufficiently above the poverty threshold that households would lose their eligibility for a substantial fraction of the various social welfare payments they currently receive, including earned-income tax credit checks, food stamps and housing subsidies.”

Unz, whose fortune comes from founding Wall Street Analytics Inc., argues that by not paying a living wage, companies are forcing the government to subsidize them through massive welfare spending. An advocate for the free market, Unz opposes any kind of subsidy. The wage proposal has led him to work with strange bedfellows, including Ralph Nader, the consumer advocate and former independent presidential candidate, and progressive economist James Galbraith.

Unz, 52, trained as a theoretical physicist, has an IQ of 214 and has written scholarly papers on the Spartan naval empire. His political rivals and allies alike have made much of his nerdy demeanor. But his unorthodox background seems to have given him the confidence to go against the conventional wisdom of his party.

“The thing that’s really shocking is that the Republican response to the problem is to call for increased welfare spending. From a free-market perspective, businesses should compete without subsidies,” Unz said. “If they can’t compete, then maybe they should go out of business.”

Hanauer: helping people buy what amazon sells

Seattle venture capitalist Nick Hanauer believes the growing wealth gap threatens the economic system that has given him his wealth. One of the early investors in Amazon, Hanauer started the Internet company aQuantive Inc., which was acquired by Microsoft Corp. in 2007 for $6.4 billion.

But Hanauer said he doesn’t consider himself a “job creator.” If no one can afford to buy what he’s selling, the jobs his companies create will evaporate, he reasons. In his view, what the nation needs is more money in the hands of regular consumers.

“A higher minimum wage is a very simple and elegant solution to the death spiral of falling demand that is the signature feature of our economy,” he said in an interview with the AP last summer.

Hanauer, 54, advocates raising taxes for the rich and hiking the minimum wage to the unheard-of heights of $15 an hour. He has co-authored a book and launched an organization called The True Patriot Network to help push such proposals. In 2012, he advanced his ideas in a TED talk — one of the wonky, provocative lectures that have become a required feather in the cap of web-savvy thought leaders. But TED organizers refused to post Hanauer’s lecture on the web, because they said it was too partisan.

Silberstein: the quiet advocate

Steve Silberstein made his fortune in the early days of computers by co-founding Innovative Interfaces, a software company that creates technology for hundreds of college and university libraries. He sold the company, settled in a secluded town in Marin County, Calif., and became a philanthropist.

Now, at 70, he is a low-profile member of a movement to organize institutional investors in opposing what he and others say are exorbitant executive salaries.

Silberstein advocates a policy that would tie corporate tax rates to the difference in compensation between the CEO and an average worker. A company with a CEO-to-worker-compensation ratio at the 1980 level of 50-to-1 would pay tax at the current rate of 35 percent; companies with a larger pay gap would be taxed at a higher level, and those with a narrower gap would pay a lower rate.

Silberstein took a step into the spotlight when he produced the documentary “Inequality for All,” featuring former U.S. Labor Secretary Robert Reich. It premiered last year at the Sundance Film Festival.

“He’s one of the quiet leaders of the entire movement toward wider prosperity,” Reich said. “An increasing number of wealthy businesspeople are becoming concerned that the economy can’t function without a strong middle class to keep it going.”

Silberstein told the AP his views are not so different from that original American industrialist, Henry Ford, who famously paid his factory workers enough to purchase one of the cars that came off his assembly line.

“As a result he became rich,” Silberstein said. “If the economy goes well, everybody does well, including the wealthy.”

Like many left-leaning executives troubled by the wealth gap, Silberstein insists that his ideological views play only a small part in his concerns.

“It’s a problem, and everybody is losing as a result. It’s self-interest and the interest in my country, too,” he said.

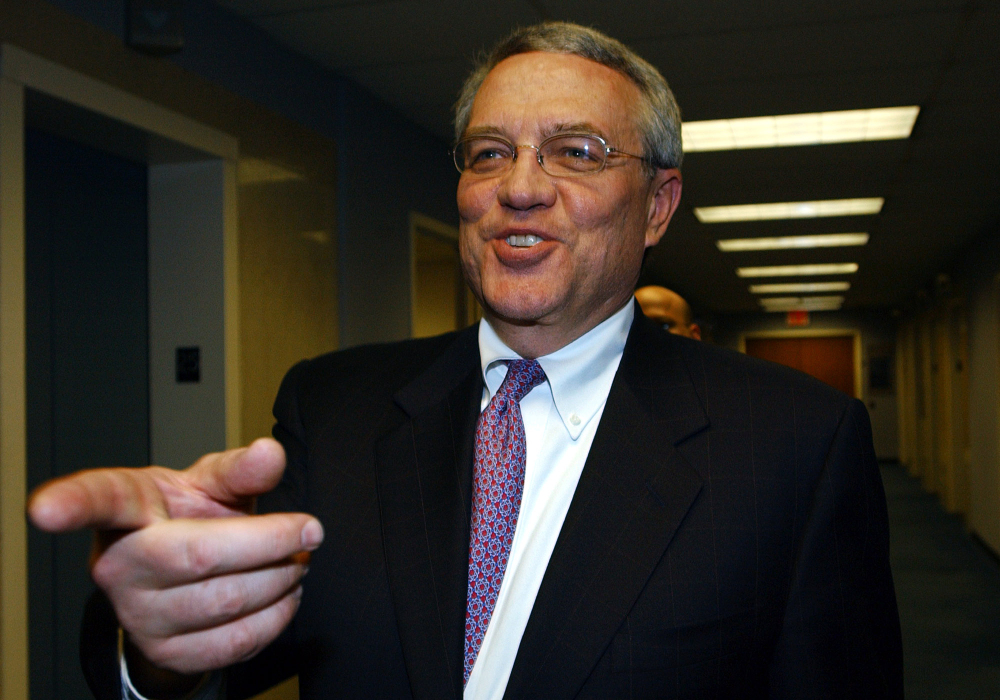

Hindery: the titan who wants to pay more taxes

Leo Hindery Jr., the New York City media and investing mogul, is one of hundreds of wealthy people directly asking Congress to raise their taxes as a member of Patriotic Millionaires. The group was formed in 2010 to advocate for the end of Bush-era tax cuts for people making more than $1 million a year. Hindery is also a member of Smart Capitalists for American Prosperity, and he was among a group of entrepreneurs who went door-to-door in the halls of Congress in early February asking for a higher minimum wage.

A managing partner of the media industry private equity fund InterMedia Partners, Hindery was previously chief executive of AT&T Broadband and of the YES Network, the cable channel of the Yankees. He says he’s turned down raises to ensure that he never makes more than 20 times the salary of his employees. He is also one of the biggest Democratic fundraisers in the nation.

The 66-year-old argues that giving rich people tax breaks makes no economic sense because people like him don’t put their extra dollars back into the economy.

“Do you think I don’t own every piece of clothing, every automobile? I already have it. You spend money. Rich people just get richer,” he told the AP.

Hindery credits his Jesuit upbringing with giving him the tools to look beyond his own economic advantages.

“How can we believe in the American dream when 10 percent of the people have half the nation’s income? It’s immoral, I think it’s unethical, but I also think that it’s bad economics,” Hindery said. “The only people who can take exception to this argument are people who want to get super rich and don’t care what happens to the nation as a whole.”

Send questions/comments to the editors.

Success. Please wait for the page to reload. If the page does not reload within 5 seconds, please refresh the page.

Enter your email and password to access comments.

Hi, to comment on stories you must . This profile is in addition to your subscription and website login.

Already have a commenting profile? .

Invalid username/password.

Please check your email to confirm and complete your registration.

Only subscribers are eligible to post comments. Please subscribe or login first for digital access. Here’s why.

Use the form below to reset your password. When you've submitted your account email, we will send an email with a reset code.